Growing markets demand precision trace humidity analysis of specialized gases

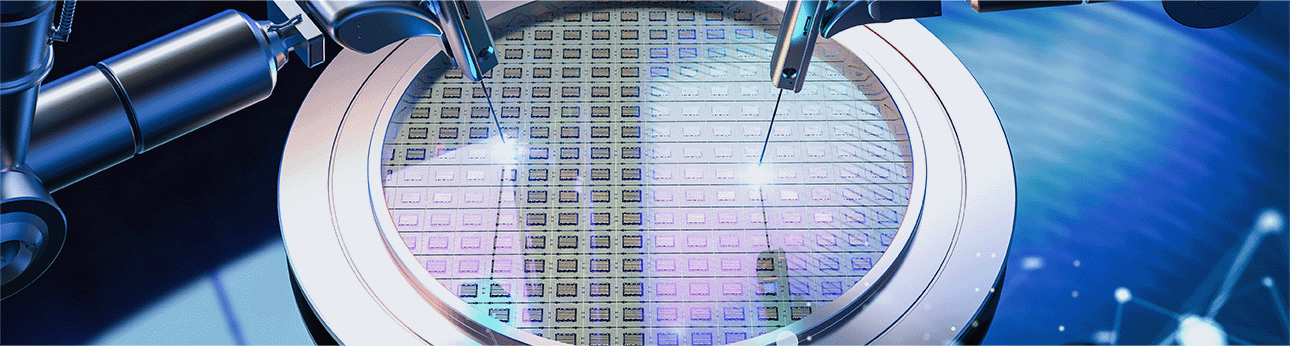

Our world is built on semiconductor chips. Almost every piece of technology we use, from smart phones and home appliances to industrial controls, cars and satellites, has at least one semiconductor at its heart.

The long-term outlook for semiconductors and, thus, for suppliers of manufacturing systems is favorable. McKinsey anticipates that the sector will almost double in size by 2030, becoming ‘a trillion-dollar industry’, with around 70 % of growth being driven by just three markets: automotive, computation and data storage, and wireless. The growth in electric vehicles, for example, will contribute significantly to market growth, with McKinsey predicting that future autonomous vehicles will each require semiconductors worth $4,000, compared with just $500 in one of today’s combustion engine-powered cars.

However, recent events have had a significant negative effect on the industry. Just a few years ago, it was predicted that the market for semiconductors would grow fast – almost exponentially – as global demand for new consumer and commercial technologies began to sky-rocket. Then, along came Covid, wrapped up with inflationary pressures, rapidly rising interest rates and a collapse in consumer confidence in countries around the world. Demand, along with the supply chains that feed markets and manufacturers, has – at least, temporarily – stalled.

Management consultant and market analyst Gartner projects that global semiconductor revenues will fall by 3.6 % in 2023, with the memory market being hit even harder by ‘swollen inventories and customers pressing for considerably lower prices’. However, PST’s experience with OEMs that supply systems to chip manufacturers indicates that demand for production equipment will remain strong for the immediate future, as companies gear up for new product launches while protecting their revenues by reshoring their sources of supply.

Semiconductor manufacturing

The projected growth in demand for semiconductors is clearly good news for the different semiconductor fabrication plants and integrated device manufacturers. Although, historically, most production has been centered in North America, Korea, Japan, Taiwan and China, there is a growing move to build new fabrication plants in other countries. This is partly due to the need to shorten and improve the resilience of supply chains and partly because of concerns over potential geopolitical risks, especially with regard to China and the Far East. For example, the Europe Union has announced its intention to become a major semiconductor manufacturing hub, with the goal of increasing its share of the global semiconductor market from 9 % today, to 30 % by 2030.

Whatever the outcome, meeting the anticipated demand will depend on ever-more advanced fabrication technologies, greater end-to-end process digitization and integration, better use of AI and predictive maintenance and the wider adoption of sophisticated process monitoring and management systems. The latter will help to maximize yields through improved quality control, enhanced productivity and reduced energy consumption – even a small percentage increase in yield can represent a significant increase in output, along with the potential to reduce production costs.

Precision trace measurement in specialized gases

Specialized ultra-high purity gases are essential for the fabrication of semiconductors. These gases include:

Throughout the fabrication process, it is essential to remove impurities if each stage is to be completed effectively with the lowest level of waste; even the presence of trace impurities measured in parts per trillion can result in the loss of an entire batch of wafers.

We’ve been working with leading manufacturers of semiconductor machines for many years, developing and supplying a wide range of high-performance oxygen and moisture analyzers and sensors, plus process gas chromatographs. These precision instruments are designed to meet the most demanding requirements of semiconductor foundries, being ideal for use in process steps ranging from deposition, lithography and etching, to doping, annealing and chamber cleaning.

Each instrument is extremely reliable, easy to use and, depending on the product and application, provides the certainty of repeatable measurements down to levels below 100 ppt.

The impact of humidity on yields

PST’s core moisture measurement products include transmitters, hygrometers and analyzers. These instruments play a crucial role in detecting trace levels of moisture in ultra-high purity gases, and in helping to prevent problems such as oxidization, the adhesion of photoresists or consistent characterization and predictability of each process stage.

Our latest Pura advanced online gas moisture sensor and hygrometer offers a simple, cost-effective and highly accurate solution for trace moisture measurement in semiconductor manufacturing. In common with all our products, it is backed by comprehensive technical, maintenance and calibration support services, with a global network of experts being on hand to provide advice and practical assistance for each application.

Discover more about the Pura Advanced Online 2.

We are the world’s leading experts in moisture monitoring and dew-point measurement. We have eight different technologies covering all moisture applications, backed by unrivalled technical and customer support. To learn more,talk to one of our application specialists today.

Our MultiDetek3 Gas Chromatograph uses the patented plasma emission detector and, thus, we are experts in the detection of sub-ppb impurities in ultra-high purity gases. Our technology and our know-how also enable us to support the electronic special gases market, giving us complete coverage of the electronic gas market. These types of applications include toxic and hazardous gas mixtures, which are increasingly required in the electronic industries, and we have the appropriate products and manufacturing installations to deal with these. Our solutions include accessories that have been designed especially for semiconductor applications, such as the LDGSS stream selector, LDP2000/LDCryo gas purification system, and the LDGDSA ppb calibrator unit; these are all integrated into our LDRack cabinets. As manufacturers, we are able to offer orbital welding – the ideal solution for the ultra-high purity electronic market. To find out more, view the links below:

LDetek Application Notes Navigate to sections on ‘Electronic Gases & Semiconductor’ and ‘Electronic Special Gases’. Many of the application notes show what can be measured with our process gas chromatograph.

Sources:

Related Products

Ultra-Pure Moisture Hygrometers

Michell Pura

Trace Moisture Transmitter - Michell Pura

Modular Process GC – LDetek MultiDetek3

Want to see more information like this?

Sign up to one of our Industry newsletters and you’ll receive our most-recent related news and insights all directly to your inbox!

Sign Up